4 Simple Techniques For Loans

Wiki Article

Quick Payday Loan - Questions

Table of ContentsPayday Loans for DummiesAll About Quick Payday LoanPayday Loan Things To Know Before You Get ThisThe Main Principles Of Payday Loan

Your employer might reject your demand, however it's worth a shot if it implies you can prevent paying expensive costs and also rate of interest to a cash advance loan provider. Asking an enjoyed one for assistance may be a tough conversation, but it's well worth it if you're able to avoid the outrageous rate of interest that comes with a payday advance. Loans.Ask your lender a lot of inquiries as well as be clear on the terms. Plan a repayment plan so you can repay the lending in a timely fashion as well as avoid coming to be overwhelmed by the added expense. If you recognize what you're entering as well as what you need to do to leave it, you'll repay your finance quicker and decrease the influence of shocking rates of interest and fees.

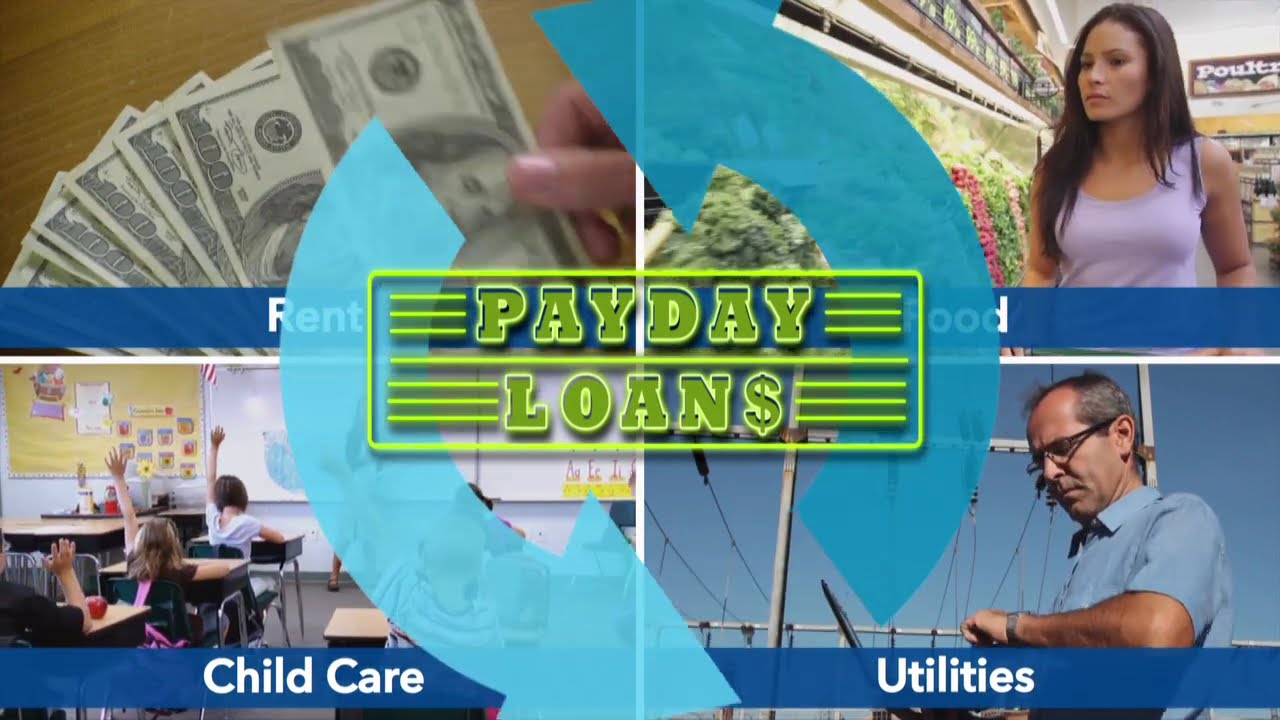

What ever before the reason you need the car loan, prior to you do anything, you need to understand the pros and cons of cash advance car loans. Payday fundings are small money car loans that are supplied by brief term loan lending institutions.

Below are the advantages that consumers are seeking out when obtaining payday advance. With these cash advance lendings, obtaining cash money quickly is a function that payday advance loan have over its conventional competitors, that call for an application as well as after that later on a check to submit to your bank account. Both the authorization procedure as well as the money may deliver in much less than 1 day for some applicants.

5 Easy Facts About Payday Loan Described

Pay stubs and also proof of work are extra critical to the authorization of your application than your credit rating. Almost any person with a steady work can look for a cash advance, after simply addressing a handful of inquiries. These financing applications are additionally far more basic than traditional choices, leaving room for the client to be as private as they need to be regarding their lending.

While there are a number of pros and also cons of payday finances, online lender accessibility makes this alternative a real ease for those who require cash money quick. Some consumers appreciate the privacy of the web lending institutions that only ask marginal questions, evaluate your revenue, as well as down payment money right into your account shortly after you have digitally authorized your contract.

All About Quick Payday Loans Of 2022

Like all excellent financing choices, there are concerning attributes that balance out those eye-catching advantages. As accessible as something like a cash advance is, it can be something that is too excellent to be real. As a result of the customers that these short-term lending lending institutions draw in, the disadvantages can be more damaging to these consumers and their financial states (Loans).Some customers discover themselves with rates of interest at fifty percent of the loan, and even one hundred percent. By the time the financing is paid off, the amount obtained and also the interest is a total of two times the original financing or even more. Because these prices are so raised, customers discover themselves unable to make the complete payment when the next check comes, enhancing their financial obligation and also straining themselves financially.

Some of these short term car loan lending institutions will include a charge for consumers that attempt to pay their funding off early to remove some of the interest. When the cash advance is acquired, they expect the payment based upon when a person is paid as well as not previously in order to collect the interest that will certainly be accumulated.

If the cash advance is not able to be paid completely with the next check, and the balance must surrender, the client can expect yet another cost that resembles a late charge, charging them even more rate of interest basically on the cash advance finance. This can be troublesome for a household and also stop them from being able to prosper with a finance - Loans.

See This Report about Quick Payday Loans Of 2022

Numerous customers find these repayment terms to be ruining to their finances as well as can be more of a burden than the need that triggered the initial application for the funding. Often customers find themselves not able to make their payday advance repayments and pay their costs. They sacrifice their repayment to the payday advance loan business with the hopes of making the repayment later on.

As soon as a debt collection agency gets your financial debt, you can anticipate they will certainly call you frequently for payment by means of phone and also mail. Must the debt remain to linger, these debt collection agency may have the ability to garnish your wages from your paychecks till your debt is accumulated. You can establish from the individuals state laws - Loans.

Report this wiki page